Transferring a company is working on the future

What does it take to successfully lead a company? Technical knowledge, leadership skills and personality – on this we can quickly agree. What does it take to successfully transfer a company? Many questions and anxieties arise here…

By Martina and Alexander Koch

Ideally, one only transfers a company once in a lifetime. As a result, the knowledge for the right procedure is naturally missing. Still transferring the company successfully is then a masterpiece of entrepreneurial skill but also a challenge. As a result, we have been supporting SME companies for many years in this phase of upheaval. Similar questions repeatedly arise in this regard.

When and how does one actually begin with the transfer?

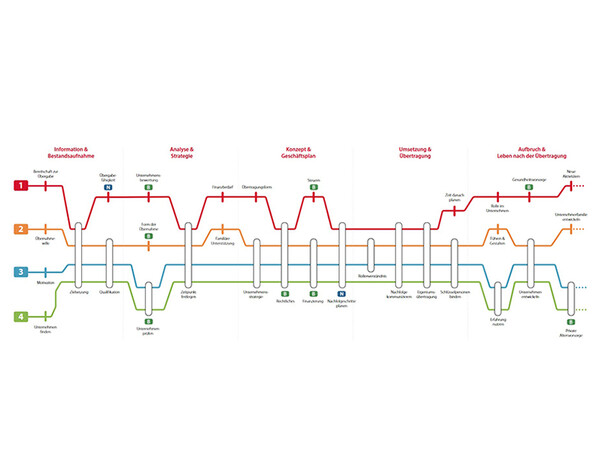

To ensure that there is enough time for all aspects of the transfer and the decisions can be made in peace, we recommend a period of at least three to five years for the transfer process. This is because an adequate period is required to find a successor, regulate the legal and financial aspects and get the workforce involved in this change process. The proprietor also needs attention in order to prepare for the post-entrepreneurial period and to be able to let go.

Is selling or passing on the company to children or employees better?

Big money is expected from a sale. The temptation is to be rid of all responsibility with one blow in return for a large infusion of capital to the bank account. Is it really that simple? In practice, our experience shows that entrepreneurs have close emotional ties to the business. For them, selling is incompatible with their personal values and the long-term relationships with companions. There are usually problems inside the family too, since distributing the money quickly leads to strife.

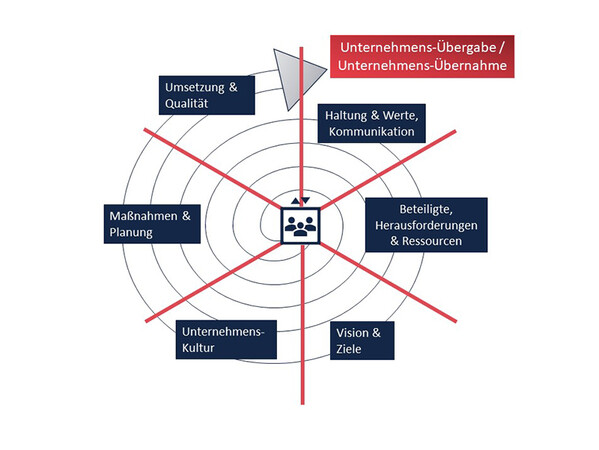

Company handover. Photo: © Martina und Alexander Koch

Company handover. Photo: © Martina und Alexander KochWhat is in favour of selling is that one does not have to decide who continues to lead the business and how the shares are distributed. Moreover, people take over the company who are genuinely interested in it. No method is better or worse than the other. The question is what is important to the transferor and what is the specific situation of the company and of the entrepreneur?

Isn’t the internal transfer method more troublesome and less financially attractive? Why would one choose this?

Because it pays off in every respect! This is what we observe time and again. Proprietors are proud if familiar people successfully grow into the task of company management. It is gratifying when those who take over successfully configure their future and that of the business.

On the other hand lies the temptation of supposedly easy money. But let’s be honest: when have you ever made easy money in your business life? It is an illusion because in its train come many factors you had not considered. You have every detail of your company in your head but this information has to be made transparent for the sale. There is also a reason why your employees work for you and not for a group.

Particularly when it comes to lift companies, we have observed that independent working is highly appreciated and team members are prepared to assume responsibility. Performing good work in the varied environment of an SME is important to them. At the same time, a special feeling of togetherness has developed within the business. Precisely this is important to companies: preserving this very special work environment. Therefore, they opt for internal transfer out of conviction.

Who can advise me on this?

Apart from tax consultants, notaries and bankers, advisors who are experienced in supporting company transfers are of assistance. Ask in your circle or your business support organisation. Speak to various candidates since the chemistry is decisive in transfers. You need someone you can trust! After all, more is involved than facts, figures and data. You want to be sure you make the best decision for yourself, your family and your business.

Make use here of your network of trustworthy contacts and avoid being drawn into hasty decisions. Anyone who means well understands the gravity of the decision and grants you the time needed.

How do I arrive at an appropriate purchase price?

What is an appropriate price? One, two or three million above the actual worth? Experience here shows that independent experts can answer this question best and provide an honest assessment. Take the market and successor situation into account and ask how far you are willing to "gamble". As for the rest, it all depends on your negotiating skill. Your motivation also plays a role: you may not just want to achieve the best price but also facilitate the takeover for the best successor.

Succession timetable. Photo: © Martina und Alexander Koch

Succession timetable. Photo: © Martina und Alexander KochWhere does the buyer get the money?

There are many options – from self-financing to various forms of borrowing. The Federal Ministry for Economic Affairs provides useful information on basic questions. Tax consultants are likewise valuable contacts. When it comes to financing, the KfW (Kreditanstalt für Wiederaufbau) can assist, for example, or your own bank. There are also various support programmes. Finally, it depends on the individual financial situation and what kind of transfer you select.

Transferring a company appears to be a mammoth task. How is it to be accomplished?

Right at the start of the process of supporting the transfer, we take time to get to know the goals and values of those involved. What counts for the individuals? After all, you remain a family and want to get the job well done together. Openness, transparency and clear communication accomplish a great deal, ensuring the joint work for a successful future of the company can succeed.

Martina Koch is knowledge manager, Alexander Koch systemic business coach for organisational development. Martina Koch recently held a workshop on the internal takeover of a company at the GAT junior conference.

More information: c3-concept.de

knowledgexcellence.com

Write a comment